Archive for February, 2008|Monthly archive page

Founders as CEOs – Noam Wasserman

Day 14, Thursday 6th Feb: Noam Wasserman is an Assistant Professor of Business Administration at Harvard Business School. He has taught on Harvard’s MBA course (Entrepreneurial Management), and the University’s Doctoral and Executive Education programs. Noam received his PhD in Organizational Behavior (with concentrations in Sociology and Microeconomics) from Harvard University in 2002, and received an MBA (with High Distinction) from Harvard Business School in 1999, graduating as a Baker Scholar. Noam talked to us in the afternoon about founders of companies becoming CEOs and the various trends/statistics related to this. In particular he focused on issues that arise for these CEO/Founders later on in the venture following SeriesA/B of VC investment. Sometimes VCs want to replace a Founding CEO once he had brought the company throught he hard times and success is on the horizon. The reasons being that perhaps now once the company is about to take on a massive scale the VC wants someone they know at the wheel, despite the Founder’s efforts up to that point. I found his talk extremely interesting, insightful and practical. Summary of key points:

Day 14, Thursday 6th Feb: Noam Wasserman is an Assistant Professor of Business Administration at Harvard Business School. He has taught on Harvard’s MBA course (Entrepreneurial Management), and the University’s Doctoral and Executive Education programs. Noam received his PhD in Organizational Behavior (with concentrations in Sociology and Microeconomics) from Harvard University in 2002, and received an MBA (with High Distinction) from Harvard Business School in 1999, graduating as a Baker Scholar. Noam talked to us in the afternoon about founders of companies becoming CEOs and the various trends/statistics related to this. In particular he focused on issues that arise for these CEO/Founders later on in the venture following SeriesA/B of VC investment. Sometimes VCs want to replace a Founding CEO once he had brought the company throught he hard times and success is on the horizon. The reasons being that perhaps now once the company is about to take on a massive scale the VC wants someone they know at the wheel, despite the Founder’s efforts up to that point. I found his talk extremely interesting, insightful and practical. Summary of key points:

– VCs on biggest reason for failure of new ventures

– 65%: problems within founding or management teams

– Statistic hasn’t change din 15 years!

– Dynamic vrs static equity splits

– Organically/vesting based on effort/time/milestones

– Past/future contributions

– Opportunity cost

– Willingness to fight for equity stake

– Team stability does not necessarily imply team success

– Founder as CEO less likely to leave so less likely to get a raise later in venture

– Mr X, Founder & CEO: implies that he’s CEO because he was founder

– Mr X, President & CEO: fit for purpose, presumably!

– http://founderresearch.blogspot.com/

New Venture Bootcamp (Part 2) – Ted Zoller

Day 14, Thursday 6th Feb: Ted Zoller returned for part 2 of his “New Venture Bootcamp” (Part 1). He compared the coming 2 day-seminar, the business knowledge and training he was imparting, to a mini-MBA! MBA or not Ted’s second day with us proved as impressively informative and practical as we had come to expect from him! He presents topics with fantastic clarity and all but eliminates unnecessary jargon that usually only inhibit concept comprehension and adoption.This morning’s seminar focussed on the following 8 topics:

Day 14, Thursday 6th Feb: Ted Zoller returned for part 2 of his “New Venture Bootcamp” (Part 1). He compared the coming 2 day-seminar, the business knowledge and training he was imparting, to a mini-MBA! MBA or not Ted’s second day with us proved as impressively informative and practical as we had come to expect from him! He presents topics with fantastic clarity and all but eliminates unnecessary jargon that usually only inhibit concept comprehension and adoption.This morning’s seminar focussed on the following 8 topics:

1.) Seeking the value proposition

– Review of previous seminar & value propositions

– Value = relevant brand benefits/relative competitive price

– VP should take the following basic form:

Our innovation is a: (customer language)

That: (key benefit)

Unlike: (current state/key customers)

Ours: (key differentiators)

For: (beachhead customer)

Who: (key purchase motivation insight)

At a price/value: (relative to competitors)

Value Outcomes/Results: (client deliveries)

e.g.: Scholarpub.com is a proprietary search engine and repository that securely publishes scholarly research both in secure and open environments to network students, scholars, and researchers for the purpose of sharing data, promoting collaboration, and creating new knowledge.

2.) Business model development

– A business model is a conceptual tool that contains a big set of elements and their relationship…expressing the business logic of a specific firm.

– Can you be born global?

3.) Discovering the market

– Identifying customers and addressable markets through research

4.) Segmentation and Beachhead

How do you see your markets? How do you segment it? How are you going to position in the market? How do you see your Beachhead? Marketing comes down to you’re clarity regards:

– What you’re offering

– What its value is

– Who you’re offering it to

Ted also discussed the difference between combining and dividing segments

5.) First mover ‘advantage’

– not necessarily a winning approach

– expensive & risky, but potentially very rewarding

– cons: free-rider effect; technological discontinuities; shifts in consumers’ tastes; incumbent inertia; identification of ideal points

– Late entrants can leapfrog with: superior tech/quality/customer service/brand image

– The logic of success is not to be first to market, but to strive for market leadership by scanning opportunities, building on strengths, and committing resources to customers effectively

6.) Positioning and differentiation

– Identifying firm’s ‘ideal point’ in market and differentiating your offer

– Physical vrs Perceptual positioning

7.) Market plan development

– Segmentation; positioning; 1st mover/late entrant; entry strategy; differentiation

– Always novice tendency to under-budget on marketing

– Budget abundantly to key marketing milestones

– Consider gorilla marketing as apposed to full promotional marketing campaigns e.g. blogging

8.) Crossing the chasm

– See Melissa Schilling’s seminar on technical innovation

Lesa Mitchell – University $pinout$

Day 14, Thursday 6th Feb: Lesa Mitchell is VP for Advancing Innovation with the Kauffman Foundation. She has been responsible for the Foundation’s frontier work in understanding the policy levers that influence the advancement of innovation from universities into the commercial market. Lesa presented various issues related to University spin-outs, but in particular she emphasised the limitations inherent in University Tech Transfer departments. She analogised that VCs specialise in niche markets and realise significant returns in this way due to comprehensive knowledge and understanding. Using this analogy she continued to emphasise that tech-transfers departments are unable to best meet the requirements of University spin-outs as they are forced to stretch themselves thin and deal with spin-outs from all departments e.g. IT, life sciences, physical sciences etc. In this structure University startups are at an immediate disadvantage.

Day 14, Thursday 6th Feb: Lesa Mitchell is VP for Advancing Innovation with the Kauffman Foundation. She has been responsible for the Foundation’s frontier work in understanding the policy levers that influence the advancement of innovation from universities into the commercial market. Lesa presented various issues related to University spin-outs, but in particular she emphasised the limitations inherent in University Tech Transfer departments. She analogised that VCs specialise in niche markets and realise significant returns in this way due to comprehensive knowledge and understanding. Using this analogy she continued to emphasise that tech-transfers departments are unable to best meet the requirements of University spin-outs as they are forced to stretch themselves thin and deal with spin-outs from all departments e.g. IT, life sciences, physical sciences etc. In this structure University startups are at an immediate disadvantage.

In the past VCs played a very interactive role by directly networking (not virtual!) with academia and thus maintaining an awareness of projects relevant to their investment interests. Lesa proceeded by describing a project called iBridge Network. iBridge is recreating this approach of directly connecting VC/Fund sources to academics. “iBridge provides the transparency and access to university developed innovations that will lead to further advances and next-generation products. The Network aggregates research materials, technologies, and discoveries in an online, easy-to-search forum—the iBridge Web Site”

Entrepreneurial marketing & Sales – Bill Aulet

Day 13, Wednesday 6th Feb: Bill Aulet is a senior lecturer at MIT’s Sloan School of Management and Entrepreneur in Residence at the MIT Entrepreneurship Center. He has 25 years of experience in technology business operations and financing. He started his career at IBM and then ran two private companies, Cambridge Decision Dynamics and SensAble Technologies. Most recently he helped engineer a dramatic turnaround at Viisage Technology as its Chief Financial Officer. He has created hundreds of millions of dollars of shareholder value by building focused, fundamentally sound businesses. He has raised $100 million in institutional financing via private placements and public offerings. Mr. Aulet now works with students and start-up companies to build strategies and operating plans that will create sustainable value. He has an undergraduate degree from Harvard University and a graduate degree from the MIT Sloan School of Management, where he was a Sloan Fellow.

Day 13, Wednesday 6th Feb: Bill Aulet is a senior lecturer at MIT’s Sloan School of Management and Entrepreneur in Residence at the MIT Entrepreneurship Center. He has 25 years of experience in technology business operations and financing. He started his career at IBM and then ran two private companies, Cambridge Decision Dynamics and SensAble Technologies. Most recently he helped engineer a dramatic turnaround at Viisage Technology as its Chief Financial Officer. He has created hundreds of millions of dollars of shareholder value by building focused, fundamentally sound businesses. He has raised $100 million in institutional financing via private placements and public offerings. Mr. Aulet now works with students and start-up companies to build strategies and operating plans that will create sustainable value. He has an undergraduate degree from Harvard University and a graduate degree from the MIT Sloan School of Management, where he was a Sloan Fellow.

Bill’s seminar titled “Entrepreneurial Marketing & Sales”was most definitely my favourite seminar so far as a Global Scholar. His unique combination of commercial “successes” and “failures”, academic excellence, and charisma makes him intriguing to listen to. When Bill started talking about this experiences my brain clicked into auto-pilot as he shared such practical and interesting knowledge with us. I felt privileged to have the opportunity to meet with him in a small seminar. Talks like Bill’s are what make the Kauffman Fellowship so unique – you simply wouldn’t hear it in ANY business school! His presentation was in 2 parts, with the following specific outcomes related to each part:

Part 1

1. Increase understanding of the definition of entrepreneurial marketing

– How entrepreneurial marketing differs from traditional marketing

– The different elements of marketing and what is most important to an entrepreneur

2. Increase understanding of the role of entrepreneurial marketing

– Unique and crucial role

– How integrates with other functions

3. Increase understanding of how to effectively implement this function in a new enterprise

– Framework

– Practical considerations and tradeoffs

Part 2

1. Increase understanding of the different types of customers when starting a business

2. Become comfortable with steps and elements of Entrepreneurial Marketing Implementation Framework

3. Real world case studies – SensAble Technologies & Brontes Technologies

Some of the main points Bill emphasised included the following:

Team goals

– Co-founders MUST be aware of what each member of the team wants out of the project, what their vision is, when/how they want to exit.

– There MUST be synchronicity among the team in this regard to be successful

– Being aware of this makes the journey and decision encountered easier, or at least oriented in a direction.

Market selection – need to be able to do disciplined market selection, and have the ability to deselect markets (in order to focus the business)

– Get extremely efficient at one market

– Don’t sell your soul (diversify unnecessarily) for money, or payroll (easier said than done)

Raison d’Etre

– Product Innovation

– Low Price

– Customer Intimacy– 3 question to bare in mind when selecting a market

– What do we want?

– What are our competitors doing?

– What do our customers want?

– Get to know and understand the customer intimately – entrepreneurial marketing is a not a spectator sport!

– What’s their real pain?

– Is it common among customers?

– Can I address it effectively in a unique way?

– Keep asking them questions….

– Customer does not imply Market! – Technology push versus market pull

– * Book: Geoffrey A Moore – ‘Inside the Tornado’ (Google books)

– * Book: Richard C. Dorf, Thomas H. Byers – Technology Ventures: From Idea to Enterprise (Google books)

– Categories of technology adopters – same as Melissa Schilling’s description

– Bill discussed how one crosses the charm between some sales to innovators & early adopters to determining the beachhead market.

– A key thing is doing this is

– (as mentioned above) becoming “intimate” with your initial innovator customers – leverage the first pin/beachead

– Carrying out a comprehensive and tedious market analysis

– When obtaining first VC funding:

– Better to obtain too much $ than too little

– Need to be 100% confident that you can meet objectives within time with available money

– Get continuous advice from mentors as VC will abuse their dominant position dealing with a novice

– “The most important thing during funding cycles is that the team doesn’t cut corners on culture”

– When crossing the chasm:

– Revenue may be reasonably high but profit will most likely be non-existent – which will be part of the plan

– Bill’s marketing mantra – “Keep the main thing the main thing”

– Take the business very seriously, but not yourself

– “An entrepreneur is the person who solves the right problem at the right time”

– Reoccurring revenue is king

– Innovate on the business model – be disruptive here, not just on technology (e.g. Google)

– Bill advised us to try and maintain the attitude that “I am always open to rational business discussions”

Entrepreneurial Finance – Ramana Nanda

Day 12, Tuesday 5th Feb: Ramans Nanda is assistant professor of business administration at the Harvard business school. He currently teaches Entrepreneurial Management in the first year of the MBA program. He has also had teaching experience in Entrepreneurial Finance at MIT’s Sloan School of Management. Ramana went into brilliant detail on how to value new ventures seeking ‘Series A’ VC funding. He was very thorough in detailing VC Term Sheet pitfalls. We went through a case study on start-up valuations and used this as basis to discuss the finer details of valuation techniques & formulae. Some of the obvious techniques for valuation:

Day 12, Tuesday 5th Feb: Ramans Nanda is assistant professor of business administration at the Harvard business school. He currently teaches Entrepreneurial Management in the first year of the MBA program. He has also had teaching experience in Entrepreneurial Finance at MIT’s Sloan School of Management. Ramana went into brilliant detail on how to value new ventures seeking ‘Series A’ VC funding. He was very thorough in detailing VC Term Sheet pitfalls. We went through a case study on start-up valuations and used this as basis to discuss the finer details of valuation techniques & formulae. Some of the obvious techniques for valuation:

– Projections, bottomup – Discounter Cash Flow (DCF)

– Competitors/Comparables

– Whats in the package – team, IP, products etc..

– “VC method”

In relation to the “VC method” Ramana focused on the dynamic relationship between Projected Market Value, Discount Rates, Post Money Valuation and VC investment. After a brief well needed interval Ramana proceeded to discuss Convertible Preferred Stock and Participating Convertible Preferred Stock. This was something covered by Niall O’Donnell last week but Ramana’s version was from a academic stand point whereas Niall’s appeared to be derived more from practical experience as a VC. The seminar then changed to a discussion on the Board of Directors and various issues related to Director selection including:

– Experience – in business, with vast contacts/networks

– Scientific Advisory Board – implies legitimacy (used where appropriate)

– Widespread resources across various Directors

– Odd number of Directors – avoid stalemates

– Authority/conflict of interest issues related to have VPs on board alongside CEO

Bo…dacious!

Day 11, Monday 4th Feb: To start off week 3 Eugene Fitzgerald Professor of Materials Science and Engineering at MIT gave a seminar titled “Amberwave: Innovation in Science and Technology”. This talk focused primarily around his experiences in bringing Amberwave, a company he co-founded, to fruition. A few points from Eugene’s talk:

Day 11, Monday 4th Feb: To start off week 3 Eugene Fitzgerald Professor of Materials Science and Engineering at MIT gave a seminar titled “Amberwave: Innovation in Science and Technology”. This talk focused primarily around his experiences in bringing Amberwave, a company he co-founded, to fruition. A few points from Eugene’s talk:

– There are distinct periods that focus either on Services/Know-how or IP (patenting)

– Its essential for already wealthy countries to embrace immigration in order to drive an innovative society

– Amberwave persisted with their IP/patenting strategy and managed to win against a huge Bluechip which now licences their technology, allowing them to redirect resources and enter new markets

On Monday I also met with Bo Fishback, the VP of entrepreneurship at the Kauffman Foundation. Bo was an absolute delight and pleasure to talk to. Coming from a techie background we found lots of common ground for interesting discussion. In particular we discovered a very common ground on one particular project on which I’m currently working. Bo is a very passionate entrepreneur. His enthusiasm is contagious and his energy has a magnetic affect on you. All this said I endeavour to always approach even the most favourable of situations objectively and with a level head – so I discussed this particular project and many other ideas I have with Bo. Likewise, he detailed some of the projects he has on the back burner – interesting indeed! I plan on meeting with Bo again ASAP for a discussion targeted at REHEAT.

On Monday I also met with Bo Fishback, the VP of entrepreneurship at the Kauffman Foundation. Bo was an absolute delight and pleasure to talk to. Coming from a techie background we found lots of common ground for interesting discussion. In particular we discovered a very common ground on one particular project on which I’m currently working. Bo is a very passionate entrepreneur. His enthusiasm is contagious and his energy has a magnetic affect on you. All this said I endeavour to always approach even the most favourable of situations objectively and with a level head – so I discussed this particular project and many other ideas I have with Bo. Likewise, he detailed some of the projects he has on the back burner – interesting indeed! I plan on meeting with Bo again ASAP for a discussion targeted at REHEAT.

One point Bo made to me was regards determining ‘Product Market Fit’. His take on this was that one has to discover where the natural boundary between ‘technology push’ and ‘market pull’ lies. This may sound obvious but figuring this out with any product is the key to survival! He also suggested one approach to innovation which involves envisaging the future of your market of interest and regressing to the present – the skill lies in the regression and how one determines incremental steps along this path. On a random note, Bo a couple of interesting organisations he point out to me: Rave Wireless, The Foundry.

In the evening Carl Schramm hosted all the Global Scholars at his favourite BBQ joint in KC – jack’s stack. He, humorously, insisted on ordering for all 12 of us!! The food was fantastic and the conversation with Carl’s other guests, Michael Levin and Frank Douglas, was intriguing.

Carl & George W – because they can!

Day 10, Friday 1st February:

We had no seminars today so Stuart Varrall and I organised some meetings to make full use of the spare time. This included one meeting with a local SME working in the mobile space interested in Stuart and my projects.

Later in the day we met with Harold Bradley the chief investment officer for the Foundation who is responsible for directing the Foundation’s $2.4 billion portfolio. Stuart and I had originally planned to discuss finance and stocks with Harold. We had not anticipated the insightful and interesting conversation and exchange of idea that prevailed! As it happens we didn’t really talk about financing at all, just about starting ventures and his personal approach to business. Harold made a few points which I think are worth sharing:

– Focus on the idea and not the money and the latter will follow promptly

– Use the media effectively – make journalists your friend

– Adapt rapidly, not incrementally to major market barriers

– Adapting incrementally means awaiting confirmation & reassurance at each tier or barrier

– Think going global from the start, not later

– Howard also recommended the following books:

– Benoit B. Mandelbrot, The Misbehavior of Markets

– Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable

– Felda Hardyman & Joshua Lerner, Harvard course text

Another meeting happened on Friday which perhaps was more important than those I was involved in. Some guy called George W. Bush joined ‘il Presidente Reale’, Carl Schramm, for a breakfast meeting with area business leaders on Friday morning in Kansas City. Ohhhh that Carl and his crazieee friends!!!

Technical Innovation – Melissa Schilling

Day 9, Thursday 31st Jan: Dr Melissa Schilling is an associate professor of management at New York University Stern School of Business where she teaches courses in strategic management and technology and innovation management. Melissa gave a seminar titled “Strategic Management of Technical Innovation” focussed on the following 7 main areas which are extracted from her book:

Day 9, Thursday 31st Jan: Dr Melissa Schilling is an associate professor of management at New York University Stern School of Business where she teaches courses in strategic management and technology and innovation management. Melissa gave a seminar titled “Strategic Management of Technical Innovation” focussed on the following 7 main areas which are extracted from her book:

– Types and patterns of innovation

– Standards battles and design dominance

– Timing of entry effects

– Collaboration strategies

– Protecting innovation

– Managing the new product development process

– Crafting a deployment strategy

Main points which I identified in Melissa’s presentation include:

Types and patterns of innovation

– Technology improvement occurs faster than customers adjust their requirements

– Types of technical innovation:

– Product vrs process innovation

– Radical vrs incremental innovation

– Competence enhancing vrs competence-destroying innovation

– Architectural vrs component innovation

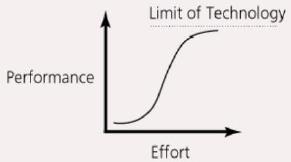

– Rate of technology improvement & adoption typically follows S shaped curve as shown in graph

– Melissa quoted Everett M. Rogers’ topology of technology adopters:

– Innovators – first 2.5% of people to adopt an innovation

– Early adopters – next 13.5%

– Early majority – next 34%

– Late adopters – next 34%

– Laggards – last 16%

– Dr Schilling posed some questions based on these general concepts:

1. Is your innovation:

– product or process?

– radical or incremental?

– competence destroying or enhancing (and for whom)?

– modular or architectural?

2. Where is your innovation on the technology s-curve? Where are competing technologies or services on their s-curves?

3. What adopter categories would be likely to choose your innovation?

4. Is this innovation disruptive? Is it likely to become a dominant design? Are industry stakeholders likely to resist this innovation? If so, why?

Melissa went on to cover 6 other areas in comprehensive detail. However there is simply too much include to include on a blog without hazing the details. To learn more about Melissa’s views on these topics check her book out:

– Standards battles and design dominance

– Timing of entry

– Collaboration Strategies

– Protecting Innovation

– Managing the new product development process

– Crafting a deployment strategy

Angel & VC Equity

Day 8, Wednesday 30th Jan: Marianne Hudson from Angel Capital Association spoke with us about ‘Trends in early stage equity and Angel investors’. Marianne emphasised a few key points surrounding angel investment:

Day 8, Wednesday 30th Jan: Marianne Hudson from Angel Capital Association spoke with us about ‘Trends in early stage equity and Angel investors’. Marianne emphasised a few key points surrounding angel investment:

– Angel funding is more likely as seed funding

– Seek our angels that can make an intellectual contribution

– Who can provide advice, not just $$$

– How to value company accurately pre-investment

– Value based on a combination of IP, contracts, sales, brand/goodwill

– Usually a 4x sales valuation

– Identify angels with whom you have chemistry, thrust, rapport

– Use referred angels – more likely to obtain investment

– Angels assume you’re going to exit

– Family business => not for equity investment

– Pitching for angel funding – Passion is key

– If you haven’t attracted investments from some of your friends and family money – why not? Also have you invested your own money?

– They’re looking for the type of people who have been working long hours unpaid on a project.

– The person is the product being pitched to angels…

– Kauffman Foundation’s resources for funding sources available online at the KF’s eventuring website.

On Wednesday I also went to a meeting with Merrilea Mayo, Director, Future of Learning Initiatives at the Kauffman Foundation. She is currently involved in a project to deploy learning-centric sports applications on mobile devices. I volunteered with three of the other Global Scholars to meet Merrilea and discuss the project and some ideas I had about location-based sports/educational games, Bluetooth tagging and Bluetooth pushing. We also volunteered to assist the software company developing the J2ME app with evaluations of the current prototype of the application.

Niall O’Donnell is a Kauffman Associate and Fellow, and is currently working with RiverVest venture capitalist firm. Dr. O’Donnell has drug discovery and development experience and a strong background in immunology. He has been involved in the formation of early-stage biotechnology companies, including a start-up developing novel peptide-based therapeutics for the treatment of pulmonary and liver fibrosis. In addition, he has worked with an Eli Lilly spin-out developing treatment for Crohn’s Disease by targeting Toll-like receptors. And last but not least Niall is from Omagh in CO. Tyrone, Northern Ireland! Niall gave us insight into his industry and advice on how to approach Angel and VC funding. Some key points from his seminar:

Niall O’Donnell is a Kauffman Associate and Fellow, and is currently working with RiverVest venture capitalist firm. Dr. O’Donnell has drug discovery and development experience and a strong background in immunology. He has been involved in the formation of early-stage biotechnology companies, including a start-up developing novel peptide-based therapeutics for the treatment of pulmonary and liver fibrosis. In addition, he has worked with an Eli Lilly spin-out developing treatment for Crohn’s Disease by targeting Toll-like receptors. And last but not least Niall is from Omagh in CO. Tyrone, Northern Ireland! Niall gave us insight into his industry and advice on how to approach Angel and VC funding. Some key points from his seminar:

– Niall provided us with a sample Term Sheet for future reference when negotiating VC terms

– Types of funding:

– 3xF’s, Angel 50-100K; VCs up to 20/30M, Hedge funds 100s Ms

– Don’t take money from people who don’t add value to the team

– Enlist respected advisors & mentors

– Find out their track record of investments and exits

– Do you like and thrust them? Rapport?

– Exit horizon – how far along is it?

– Parallel lines in embedded graph details sweet spot which combines

– % risk failure – how far along timeline/lifecycle

– Company value – VC will try to invest exactly at point ‘Series A’

– Cumulative cost – not shown in this graph

– “No one ever got sacked for buying legacy solutions!”

– Partner with bit 800lb gorilla in the industry! – show them how good your product is.

Valuing company:

– Overvalue – pointless as wont get funding

– Undervalue – want fair market value

– Comparisons are king – review similar companies that obtained funding recently (analogous to house prices on the same street!!)

– Convertible preferred stock vrs participating preferred stock

– Non-participating – profits shared based on equity from start

– Participating – investor gets initial investment out first

– Anti-dilution policies in VC Term Sheets

– Full ratchet anti-dilution – maybe for mezzanine funding when near IPO; or dangerously close to something truly innovative. But to be avoided at all other times!

– Weighted average anti-dilution – standard/common approach

– No anti-dilution terms – VC keeps same shares – very unlikely

– Board members

– Odd number

– Founder, 2-3 VCs, Independent specialist (with entrepreneurial track record and market knowledge)

– Term sheets – some key red flags

– 3X or above – would imply investor gets 3 times initial investment before

– Full ratchet

– Board with no industrial experience (lifestyle board)

– Big board => dysfunctional (maybe 5/7)

– Only 1 investor/VC – lack of opinion and network

– No shop – stops me…

– …shopping around for other VCs

– …potentially finding the true market value of the company

– Voting byclass – VC can block exit/new investment

– Options pool – good investor will want to recharge options @ each round

– Provides incentives – need to carve this out at start.

– Series A 15-20%; Series B 5-10 % of total shares.

– Beware of VCs pushing Series A expenditure to allow them to invest more at Series B before value decreases too much!

On Wednesday night we watched a film about Ewing Marion Kauffman’s life, titled: “Mr. K: A Common Man With Uncommon Vision”. This film biography captures Ewing Kauffman’s unconventional approach to life as a great American entrepreneur, Major League Baseball team owner, and philanthropist. It was a very inspiring film and I highly recommend watching it. Key to the whole story was his dedication to: sharing profits, working hard, his employees or associates as he called them. By the time Mr Kauffman’s company reached its IPO stage everyone shared in the wealth, making many people millionaires many times over, from admin assistants to VPs!

On Wednesday night we watched a film about Ewing Marion Kauffman’s life, titled: “Mr. K: A Common Man With Uncommon Vision”. This film biography captures Ewing Kauffman’s unconventional approach to life as a great American entrepreneur, Major League Baseball team owner, and philanthropist. It was a very inspiring film and I highly recommend watching it. Key to the whole story was his dedication to: sharing profits, working hard, his employees or associates as he called them. By the time Mr Kauffman’s company reached its IPO stage everyone shared in the wealth, making many people millionaires many times over, from admin assistants to VPs!

IP – Peter McDermott & Andrew Torrance

Day 7, Tuesday 29th Jan: Our first seminar in week 2 was on IP. Peter McDermott a patent attorney with Banner & Witcoff Ltd in Boston led a seminar titled “Gathering, Protecting & Avoiding Intellectual Property”. Peter works with technology-based businesses to obtain and enforce patents and other intellectual property rights, both domestically and internationally. Mr. McDermott’s practice focuses on corporate management’s coordinated procurement, licensing and litigation of intellectual property rights, in support of competitive market position, including strategic re-examination and reissue of patents before the United States Patent and Trademark Office. Peter initially emphasised that an integrated approach to IP was key. His talk was in two parts – getting IP protection, preventing infringement of other peoples’ IP protection.

Day 7, Tuesday 29th Jan: Our first seminar in week 2 was on IP. Peter McDermott a patent attorney with Banner & Witcoff Ltd in Boston led a seminar titled “Gathering, Protecting & Avoiding Intellectual Property”. Peter works with technology-based businesses to obtain and enforce patents and other intellectual property rights, both domestically and internationally. Mr. McDermott’s practice focuses on corporate management’s coordinated procurement, licensing and litigation of intellectual property rights, in support of competitive market position, including strategic re-examination and reissue of patents before the United States Patent and Trademark Office. Peter initially emphasised that an integrated approach to IP was key. His talk was in two parts – getting IP protection, preventing infringement of other peoples’ IP protection.

Getting IP protection

– Gathering evaluating and protecting company’s IP

– Primarily a competition tool

– Should follow, not lead (in most cases), the company’s business plan

– Develop an IP protection strategy

– IP is 2 edge sword, offense/defense

Patents – some key points

– Doesn’t give you the right to practise the invention

– 20 years duration in US

– Can back-date claim if someone is infringing, back to first date of publication

– To stop competitor you need issued patent

– To threaten competitor only need published application (assumption of issuance!)

– Patenting system extremely slow & inefficient – up to 5 years for issuance – potentially the product-life of software!

– Idea must not have been available to public before application (Use NDA – This means the idea was not available to the public)

– Prior Art – all previous related material e.g. earlier patents, published articles/media etc… that describe the same thing, or something that’s similar. Or offered it for sale

– Most patents based on improvements on previous patents, truly pioneering ideas very rare; tweaks

– Filed, 18 month pass then publication

– Defensively – can the patent claims stop me from what im doing

– No – too broad – invalid

– No – Too narrow – not describing what im doing

– Offensively – im seeking patent protection

– Forget about the claims of a patent

– Look at disclosure of their patent – does it describe what I want to do – to the point where my invention is obvious because of that disclosure

Trade Secrets

– No government registration

– Very difficult to protect in a digital world

– Policies & agreements in place to prevent employees leaking trade secrets

Copyright© (incl code, novel, structure)

– In US you have to register it if you want to sue based on it

– For s/w only first & last 25pages of source code (ummm, I’m thinking ALOT of ‘Hello world’ statements!!!)

Trademark image, sound, perfume, colour

– Can use REHEAT™ without registering, REHEAT® otherwise

– Goal: develop IP strategy that identifies, captures IP and evaluates if worth protecting, or required & protect if so

– Create a IP protection program

– Employee policies & procedures

– Employee record keeping

– Management review & decision making about invention records

– Secure IP if makes sense

– What to seek patent protection on:

1 – Is it technically feasibly?

2 – Assuming 1 is true – is it marketable/commercially interesting?

3 – Assuming 1&2 are true – is it patentable?

– Only file patents where you intend to do business!

Pitching ideas to companies

– I don’t have a patent, but will they agree not to use it if I pitch it to them…?!

– They will require you sign a CDW – confidential disclosure weaver

– The CDW will honour your patents/copyright, and beyond that they’ll use your idea for free => gambling!

– Solution with big companies:

– Disclose results

– Tease them with potential

– They’ll proceed with NDA if they’re intrigued and want more details

– Preventing infringement of other peoples’ IP protection

– In US no obligation to determine whether you’re infringing

– Wilful infringement – knowingly ignore patent => triple damages

– Set aside portion of budget to ensure not infringing?

– Does the patent keep competition sufficiently at bay – little bit different but does the same job – hardly worth patenting

– Some companies deliberately ignore other patents/prior art – because they think that statistically they’ll get sufficient boost from presumption of validity that comes with getting an issued of patent. Prefer to face prior art with patent than before they’ve got one. Very risky strategy.

– Idea must be “different enough”. Once issued, bad guys must prove that its not “different enough” by ‘clear and convincing’ evidence.

– Not patentability now?? – make your product the cheapest, fastest, prettiest, some unique feature that may possibly be patentable eventually

– What if a component infringes a patent resulting in claim

– Some components will infringe eventually. Put clause in contracts – sue supplier in scenario. If you can get the terms in the supply contract!

– Don’t just rely on IP for protection – use contracts to fill holes between IP => indemnification

– Maybe get infringement insurance to cover potential costs – expsensive

– Must read boiler plate on RFQ (request for quote) of potential big clients that we wish to supply to – any IP embodied in our proposals becomes free for them to use – licensing for free!! Only got the right to make a pitch -> bad day!!

– If you’re totally ignorant to infringement you’ve some chance, avoid the following:

– Inducement to infringe

– Contributory infringement

– International patent apps – ‘intend to use’ application – before you show your hand to the world – if registerable have short period of time that you’ve begun use

– IP treaties & international law – use base country to expand patent into other countries

– Rights accrue through use with a trademark, e.g. if claiming a domain name back as celebrity through ICANN. If have federal trademark (R), then better chance of getting domain back.

– Find a good IP lawyer to give advice over long periods of time – difference between getting patent, trademark, domain, saving millions by making right decisions beforehand, before walking into infringement

In the afternoon Andrew Torrance led a seminar on patenting and its role in business strategy. The seminar focused around a project called ‘The Patent Game’ which Andrew is working on at the University of Kansas. The Patent Game is a multi-player game which emulates the role that patents and manufacturing has on businesses. Basically the game allows players to control certain products and either produce those products or patent them. Other players are simultaneously making these same decisions so in this way the game emulates a commercial environment.

In the afternoon Andrew Torrance led a seminar on patenting and its role in business strategy. The seminar focused around a project called ‘The Patent Game’ which Andrew is working on at the University of Kansas. The Patent Game is a multi-player game which emulates the role that patents and manufacturing has on businesses. Basically the game allows players to control certain products and either produce those products or patent them. Other players are simultaneously making these same decisions so in this way the game emulates a commercial environment.

Basically what I gained from this session is that Patenting is not a fix-it-all approach which should be adapted by default within a business strategy. There are obviously times when its would be stupid NOT to patent an idea but the point was that its not a pre-requisite for making a project profitable. If one rushes to market and produces/manufactures first rather than spending time waiting for patents to be issued this can prove to be a more successful strategy. In addition time spent executing IP defence and prosecuting on infringements is time spent not developing your project and company.

Comments (1)

Comments (1)